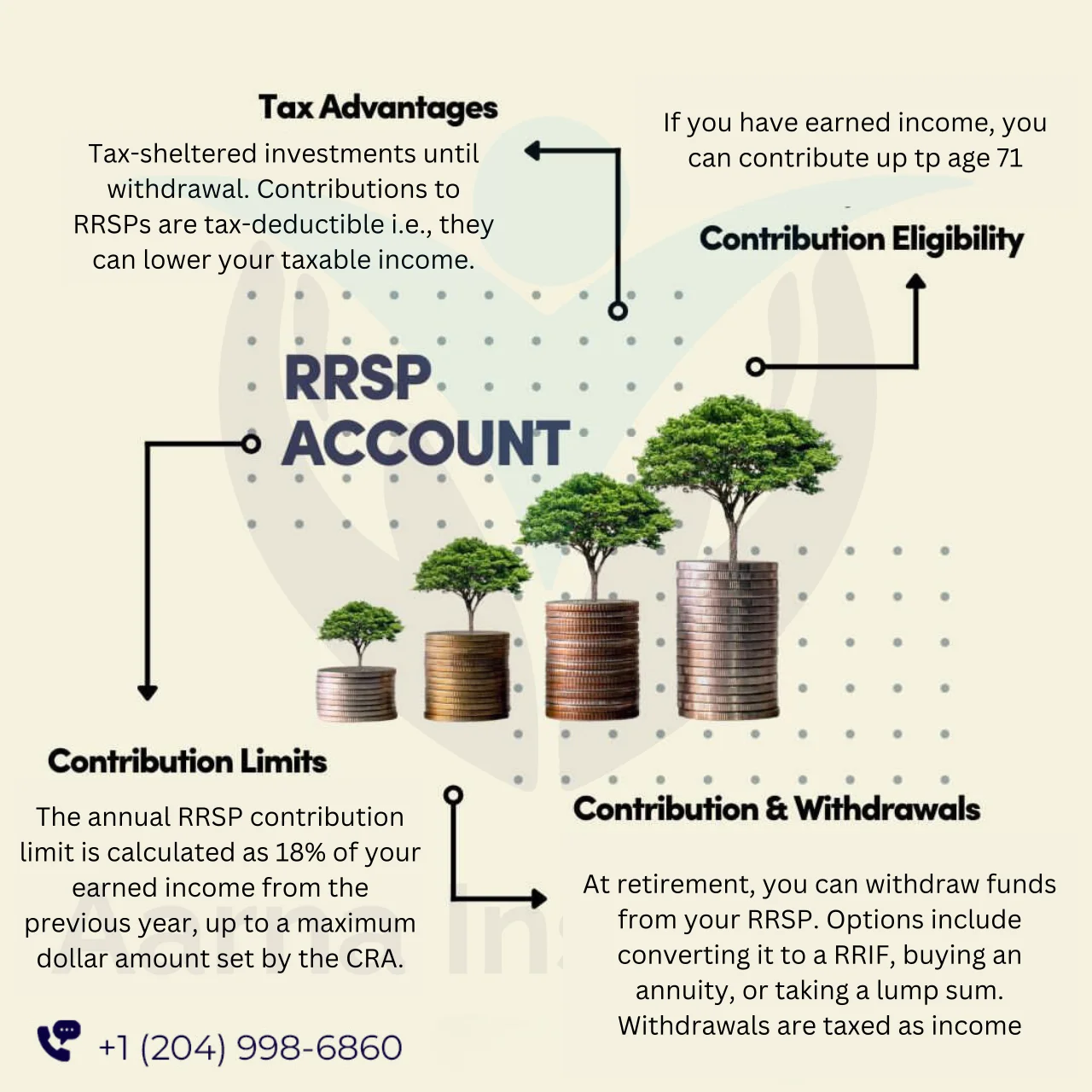

Tax-Deductible Contributions

Contributions made to an RRSP are tax-deductible, meaning that the amount contributed can be deducted from the contributor's taxable income for the year.

This deduction can result in a reduction of the contributor's income tax payable.